By Beckie Fenrick, PharmD, MBA; Jason Peterson, RPh; and Emily Crisano, PharmD, RPh

The biosimilar landscape is continuing to rapidly evolve, and 2025 marks a pivotal year for payers seeking cost-saving opportunities. With Stelara biosimilars making their debut and Humira biosimilars continuing to gain traction, plan sponsors will have more options than ever to control costs while ensuring members have access to the essential therapies they need.

Stelara: A New Frontier for Biosimilars

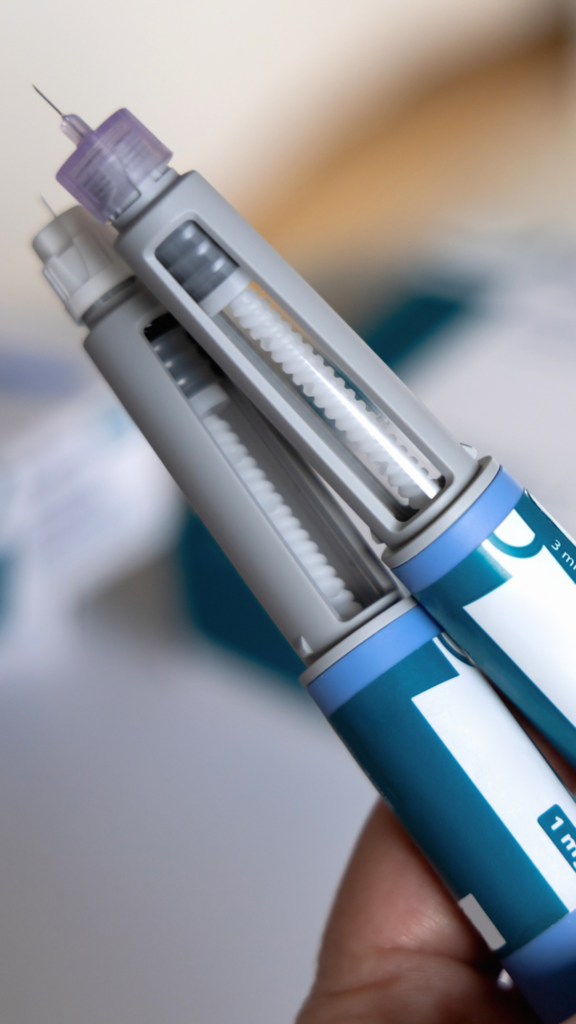

Initially approved in 2009, Stelara is a biologic that works by suppressing cytokines involved in immune and inflammatory responses. It is indicated for treating moderate-to-severe plaque psoriasis (PsO) and psoriatic arthritis (PsA) in patients 6 years and older, as well as moderate-to-severe Crohn’s disease (CD) and ulcerative colitis (UC) in adults.

Stelara Maintenance Treatment List Prices

| Indications | Induction Dose | Maintenance Dose | Dosing 100kg (220 lbs) or less | Annual Wholesale Acquisition Cost (WAC) |

| Plaque Psoriasis (PsO) & Psoriatic Arthritis (PsA) | Two subcutaneously (SC) administered doses separated by 4 weeks | SC administered every 12 weeks | 45 mg SC every 12 weeks (4.3 doses/year) | $60,419 |

| Crohn’s disease (CD) & Ulcerative Colitis (UC) | One intravenously (IV) administered dose | SC administered every 8 weeks | 90 mg SC every 8 weeks (6.5 doses/year) | $180,979 |

Stelara Biosimilar Approval and Launch Timeline

Seven Stelara biosimilars have already received FDA approval, with another under review and even more in the pipeline. The first biosimilar, Wezlana, launched on January 1, and additional biosimilars are set to launch later this year.

| Biosimilar Name | MFG | Approval | Launch Date |

| Wezlana | Amgen | October 2023 | 1/1/2025 |

| Selarsdi | Alvotech/Teva | April 2024 | 2/21/2025 |

| Pyzchiva | Samsung Bioepis/Sandoz | June 2024 | 2/22/2025 |

| Otulfi | Fresenius Kabi | September 2024 | 2/22/2025 |

| Yesintek | Biocon | November 2024 | 2/22/2025 |

| Imuldosa | Accord BioPharma | October 2024 | 5/15/2025 |

| Steqeyma | Celltrion | December 2024 | 3/7/2025 |

| BAT2206 | Bio-Thera | FDA review pending | TBD |

Vertical Supply Chain Integration

Since 2021 the Big 3 PBMs launched affiliates to distribute biosimilar products; CVS Health’s Cordavis, Cigna’s Quallent, and United Healthcare’s Nuvaila. Each private label distributor markets Humira Biosimilars and markets or intends to market Stelara Biosimilars.

| Cordavis | Quallent | Nuvaila | |

| Humira Biosimilars | Hyrimoz | non-branded Cyltezo, non-branded Simlandi | Amjevita |

| Stelara Biosimilars | TBD | TBD in early 2025 | Wezlana |

Wezlana, offered exclusively through Nuvaila, matches all formulations and strengths of Stelara while also being latex-free—a distinctive advantage in the market.

Pricing and Formulary Strategies

Wezlana debuted with a dual-pricing strategy, offering a high list price (High WAC) option that is 5% lower than Stelara and a low list price (Low WAC) option that is 81% lower than Stelara.

The intravenous formulation used for initial dose in CD and UC treatment has a list price (WAC) 33% lower than Stelara’s. ESI announced Quallent’s private-label biosimilar price will be more than 80% lower than the list price of Stelara, however product-specific details are not yet available.

Experts expect Stelara biosimilar manufacturers will adopt pricing approaches like those employed for Humira biosimilars yielding net prices (WAC, less applicable rebates) 80% lower than Stelara’s list price.

Copay Coupon Programs

PBMs like OptumRx and ESI have announced copay assistance programs for Stelara biosimilars dispensed by their specialty pharmacies. These programs will ensure most patients covered by commercial insurance will have $0 out-of-pocket costs. We expect CVS to follow suit with a similar program.

Stelara Biosimilar Uptake

Plan sponsors are prepared to embrace lower-cost biosimilars, with Wezlana’s list price being 80% lower than Stelara’s. Other manufacturers are likely to follow suit with competitive pricing to capture market share. The combination of aggressive pricing strategies, PBM formulary status and patient-friendly copay programs will determine how quickly the market transitions from Stelara to biosimilars.

Humira Biosimilars: Ongoing Market Evolution

Market Shifts and Formulary Changes

In 2024, PBMs began removing Humira from formularies and replacing it with lower-cost biosimilars. CVS led this transition, moving over 90% of Humira prescriptions to biosimilars, with 60% of those shifting to its private label Hyrimoz through Cordavis.

Other notable shifts include Navitus removing Humira in June 2024 and adding four low-WAC biosimilars, and Cigna’s Quallent launching private label versions of unbranded Cyltezo and Simlandi, with Accredo facilitating patient transitions.

By September 2024, Humira’s market share dropped from 96% to 78%, driven by formulary changes that favored biosimilars. This trend is expected to continue in 2025 as ESI, Optum and others implement similar formulary updates to prioritize these alternatives.

Pricing Comparisons

As the Humira biosimilar market expands, pricing strategies evolve. The table below identifies biosimilar WAC comparison to Humira WAC.

Percentage WAC Lower than Humira WAC

| Humira | Amjevita LC, MW | Amjevita LC, HW | Amjevita HC, LW | Amjevita HC, HW | Nuvaila Amjevita HC | Abrilada HW | Abrilada LW |

| n/a | 55% | 5% | 80% | 5% | 83% | 5% | 85% |

| Cyltezo | Non-branded Cyltezo | Quallent Non-branded Cyltezo | Hadlima | Hulio | Non-branded Hulio | Hyrimoz | Cordavis Hyrimoz |

| 5% | 81% | 46% | 85% | 5% | 86% | 5% | 81% |

| Non-branded Hyrimoz | Idacio | Non-branded Idacio | Simlandi | Quallent non-branded Simlandi | Yuflyma | Non-branded Yuflyma | Yusimry |

| 81% | 5% | 87% | 85% | 46% | 5% | 85% | 86% |

LC = Low Concentration, HC = High Concentration, LW = Low WAC, HW = High WAC, MW = Mid WAC

Of note, private label Quallent’s list prices are much higher than that of the same product distributed by the original manufacturer. Specifically, Quallent’s, unbranded Simlandi and unbranded Cyltezo biosimilar list prices are more than double that of Simlandi and unbranded Cyltezo from the original manufacturers.

There are subtleties for Amjevita’s list prices as well. Amjevita low concentration is almost two times higher than the list price of the high concentration formulation.

Access Innovations

Blue Shield of California has partnered with Evio Pharmacy Solutions to offer non-branded Idacio (adalimumab-aacf) at a net monthly price of $525—significantly lower than other Humira biosimilar products today.

Additionally, Mark Cuban’s Cost Plus Pharmacy has expanded its offerings, adding Yusimry in July 2023 and Hadlima in April 2024, providing even more affordable options for consumers.

The Road Ahead

With Stelara biosimilars entering the market and the Humira biosimilars market evolving, payers and plan sponsors are uniquely positioned to redefine value in healthcare.

What happens next will depend on the strategies manufacturers, PBMs and payers adopt. Pricing models, private label distribution and patient support programs will all play critical roles, but formulary decisions by PBMs and health plans will ultimately determine the pace of market share shifts.

Without a doubt, 2025 is a tipping point—one where collaboration and competition will drive a new era of accessibility and affordability for critical therapies.