By Beckie Fenrick, PharmD, MBA; Emily Crisano, PharmD, RPh; and Jason Peterson, RPh

The market for GLP-1 receptor agonists is expanding rapidly, driven by increasing demand for diabetes treatment, weight loss drugs and cardiovascular risk reduction. With rising prescription rates and new FDA approvals, these medications are transforming chronic disease management.

The widespread adoption of GLP-1s also brings cost challenges for employers, health plans, PBMs and patients alike. As utilization continues to surge, understanding its trajectory—and the strategies needed to balance access and affordability—will be critical for those managing pharmacy benefits in 2025 and beyond.

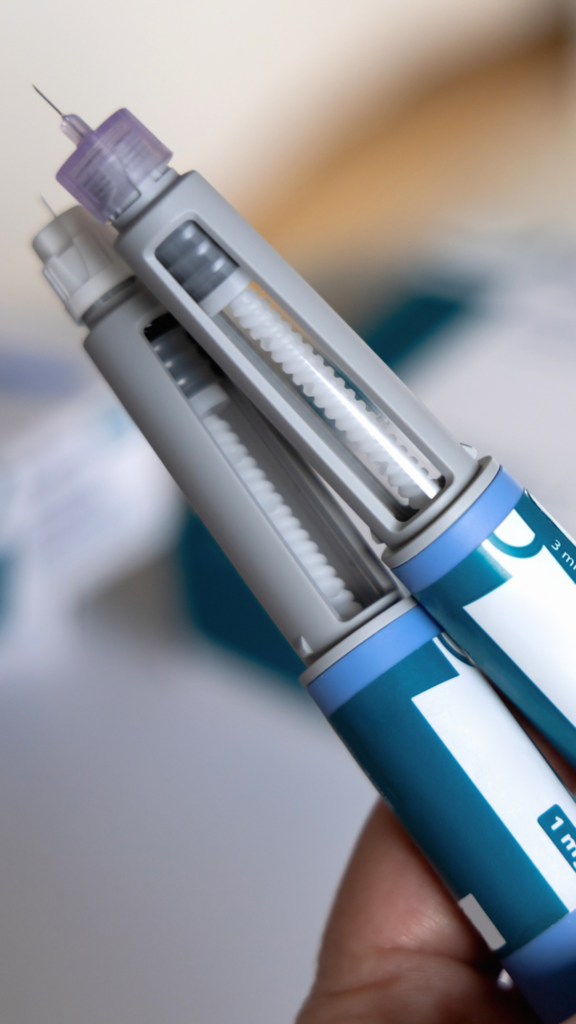

What are GLP-1 Medications?

Glucagon-like peptide-1 (GLP-1) is a hormone that regulates blood sugar levels. Secreted by cells in the small intestine in response to food intake, it binds to receptors in the pancreas, brain and other tissues, triggering several effects:

- Increases insulin secretion, lowering blood sugar

- Reduces glucagon levels, which would otherwise raise blood sugar

- Delays gastric emptying, helping regulate blood sugar spikes

- Suppresses appetite, contributing to weight loss

GLP-1 agonist medications mimic these actions, offering therapeutic benefits for certain patients. One medication in this class, tirzepatide, also mimics glucose-dependent insulinotropic polypeptide (GIP), another gut hormone that influences insulin and glucagon regulation.

The following table provides a detailed breakdown of GLP-1 medications available today and those in the pipeline:

| Product | Manufacturer | Indications | Pending Approvals-Current Phase | Cost (WAC/year) |

| Byetta (exenatide) | AstraZeneca (brand) Generic FDA approved but not yet marketed in US | T2DM in adults | $10,341 | |

| Bydureon Bcise (exenatide) | AstraZeneca | T2DM in ≥10 years | $10,786 | |

| Victoza (liraglutide) | Novo Nordisk (brand) Teva (generic) Hikma (generic) | T2DM in ≥10 years Reduce CV risk in adults with T2DM and CV disease | Brand: $9,919 Generic: $7,877 | |

| Saxenda (liraglutide) | Novo Nordisk | Obesity in ≥12 years | Obesity in Prader-Willi syndrome- Phase III Polycystic ovary syndrome (PCOS)- Phase III | $16,413 |

| Trulicity (dulaglutide) | Eli Lilly | T2DM in ≥10 years Reduce CV risk in adults with T2DM and CV disease or multiple CV risk factors | $12,833 | |

| Ozempic (semaglutide) | Novo Nordisk | T2DM in adults Reduce CV risk in adults with T2DM and CV disease Reduce risk of kidney disease and CV death in adults with T2DM and CKD | Diabetic retinopathy- Phase III Peripheral arterial disease- Phase III Non-alcoholic steatohepatitis (NASH)- Phase III Alzheimer’s disease- Phase III | $12,969 |

| Wegovy (semaglutide) | Novo Nordisk | Obesity in ≥12 years Reduce CV risk in adults with obesity and CV disease | HF in patients with obesity- 2H 2025 NASH- Phase III | $17,537 |

| Rybelsus (semaglutide oral) | Novo Nordisk | T2DM in adults | Reduce CV mortality in adults with T2DM- Phase III Alzheimer’s disease- Phase III | $12,137 |

| Mounjaro (tirzepatide) | Eli Lilly | T2DM in adults | Reduce CV mortality in adults with T2DM- Phase III | $14,037 |

| Zepbound (tirzepatide) | Eli Lilly | Obesity in adults with one other weight-related condition Moderate to severe OSA in adults with obesity | HF in patients with obesity- 3Q 2025 CKD- Phase II NASH- Phase II | $14,123 |

The Growth of GLP-1s in Healthcare

GLP-1 medications were first approved in 2005 to treat type 2 diabetes (T2D). Since then, the market has grown to 11 GLP-1 medications available in the U.S. (10 brand-name products and one generic, with another pending market entry).

Why GLP-1 Utilization is Rising

Several factors have contributed to the rapid increase in GLP-1 prescriptions:

- Updated treatment guidelines: The American Diabetes Association (ADA) updated its recommendations in 2021 to include GLP-1s or SGLT-2 inhibitors as first-line treatments for some patients. Previously, these were considered second-line therapies after metformin.

- Expanded FDA approvals: GLP-1s are now used for weight loss, cardiovascular risk reduction, moderate to severe obstructive sleep apnea, and chronic kidney disease management.

- Obesity as a recognized disease: The ADA’s 2023 update reinforced the need for weight management as part of overall healthcare.

In addition, social media and word-of-mouth have fueled a surge in consumer-driven demand for GLP-1 medications, particularly for weight loss. Celebrity endorsements and online discussions have heightened interest, while telehealth clinics and wellness programs make access easier than ever.

This growing trend has led to off-label use and increased prescriptions, raising concerns about appropriate prescribing and long-term health impacts. As demand rises, plan sponsors must ensure utilization aligns with clinical guidelines to manage both costs and outcomes effectively.

New and Emerging GLP-1 Indications

GLP-1 medications have proven highly effective for both diabetes management and weight loss. Three drugs— Saxenda, Wegovy, and Zepbound—are FDA-approved for weight loss, and additional approvals have expanded their medical applications:

- Wegovy: Approved for cardiovascular risk reduction in adults with obesity and CV disease

- Zepbound: Approved for moderate to severe obstructive sleep apnea (OSA) in adults with obesity

- Ozempic: Approved to reduce kidney disease risk and cardiovascular mortality in T2D patients with chronic kidney disease

Future GLP-1 Research & Potential Indications

Research into GLP-1 medications continues, with studies exploring their use for:

- Osteoporosis

- Peripheral arterial disease (PAD)

- Gestational diabetes

- Metabolic Dysfunction Associated Steatohepatitis (MASH/NASH)

- Alzheimer’s disease

- Parkinson’s disease

Rising GLP-1 Drug Costs & Employer Impact

With utilization at an all-time high, the financial impact of GLP-1 medications is becoming a major concern for employers and health plans. According to Mercer’s 2024 National Survey of Employer-Sponsored Health Plans, pharmacy benefit costs increased 7.7% in 2024, following an 8.4% increase in 2023—with higher GLP-1 utilization playing a significant role.

As obesity rates have tripled since the 1980s, the healthcare system now faces $173 billion in annual medical costs linked to obesity-related conditions such as heart disease, hypertension, joint pain, and certain cancers. For employers and plan sponsors, this translates to higher healthcare claims, increased prescription drug spending, and productivity losses due to absenteeism and disability.

The Cost of GLP-1s and Weight Loss Treatment

While GLP-1s have demonstrated clear health benefits, their high costs present challenges for plan sponsors. With obesity rates exceeding 40%, a company providing insurance for 100 employees could have up to 40 individuals eligible for weight loss medications. At current pricing, the cost of covering GLP-1s for this group alone could exceed $240,000 to $500,000 annually.

For some health plans, this level of spending is unsustainable and could even become the deciding factor in whether an employer can continue offering certain benefits. Many plan sponsors are weighing the long-term savings of improved employee health against the immediate financial burden of covering GLP-1s.

Additionally, these medications are not a one-size-fits-all solution. Side effects like dehydration, fatigue, and gastrointestinal issues can impact patient adherence, and weight regain is common after discontinuation. Plan sponsors must carefully evaluate cost-management strategies to ensure these drugs are used appropriately while balancing access and affordability.

GLP-1 Management Strategies for Plan Sponsors

To control costs while maintaining access for those who truly need GLP-1 therapy, plan sponsors can implement several strategies:

- Utilization Management (UM)

- Require prior authorization to ensure appropriate use

- Implement step therapy to prioritize cost-effective alternatives

- Set quantity limits to prevent waste

- Coverage Adjustments

- Some employers exclude weight loss medications all together

- If covering weight loss, limit eligibility to obese patients or those with additional risk factors

- Ensure claims systems can reject weight-loss-only GLP-1 prescriptions

- Education and Lifestyle Support

- Provide education and support for nutrition, exercise and weight management

- Cover behavioral health support to encourage long-term lifestyle changes

- Optimize PBM Partnerships

- Consider working with a pass-through PBM to lower costs

- Implement carve-outs for specialized GLP-1 utilization management

- Control Prescription Dispensing

- GLP-1 adherence is low—studies show that only 1 in 3 patients without T2D remain on therapy after one year

- Remove GLP-1s from 90-day maintenance drug programs to reduce waste

- Limit fills to 30-day supplies to improve oversight and adherence monitoring

Balancing GLP-1 Cost and Coverage

GLP-1 medications play a crucial role in diabetes treatment, weight management and cardiovascular health. However, their rising costs and widespread demand require careful strategy from health plan sponsors.

By implementing effective utilization management, optimizing PBM contracts and prioritizing coverage for high-risk individuals, employers can balance cost containment with comprehensive pharmacy benefits.

Key Takeaways for Employers and Plan Sponsors

- GLP-1 utilization is increasing due to expanded approvals, social media influence and obesity management initiatives

- Rising drug costs are significantly impacting employer-sponsored health plans

- Employers need tailored strategies to control costs while ensuring appropriate patient access

- Utilization management and PBM optimization can help mitigate financial risk

By proactively addressing these factors, plan sponsors can make informed decisions that support both financial stability and employee health outcomes.