By Beckie Fenrick, PharmD, MBA

Navigating the evolving rebate landscape requires in-depth expertise, especially as regulatory changes and PBM strategies continue to shift. For self-funded employers or fully insured groups transitioning to self-insured models, understanding rebate structures, inflation adjustments, and biosimilar pricing is more important than ever. These complexities are reshaping how employers approach their pharmacy benefits—demanding a strategic, informed approach to maximize rebate opportunities while maintaining access to affordable medications. This article explores the latest changes and provides insights to help employers adapt to this dynamic environment.

The American Rescue Plan Act of 2021 and Its Impact on Rebates

Overview of the AMP Cap Removal

The American Rescue Plan Act of 2021 removed the cap on rebates that pharmaceutical manufacturers must provide to state Medicaid programs, effective January 1, 2024. Under this change, the Medicaid Drug Rebate Program’s ancillary rebate—calculated with CPI-Urban—no longer has a limit, which could lead to rebates exceeding a drug’s average manufacturer price (AMP). This impacts manufacturers and their pricing strategies.

Manufacturer Reactions to AMP Cap Removal

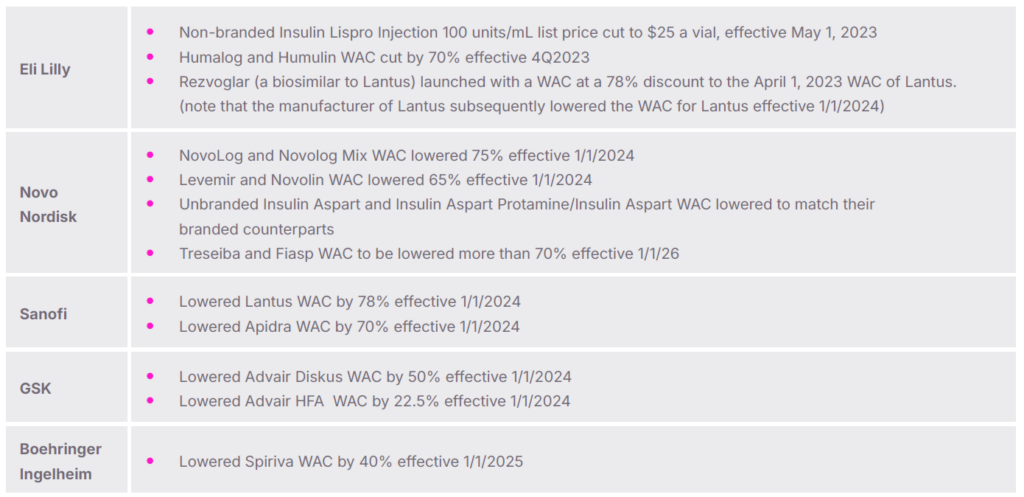

Lowering Wholesale Acquisition Cost (WAC): Some manufacturers are reducing their WACs to mitigate large rebate obligations. Examples include:

- Market Withdrawals: A few manufacturers have opted to discontinue products from the U.S. market due to the cap removal, such as GSK’s Flovent HFA and Flovent Diskus.

Impact on PBM Rebate Structures

Lowered WACs generally reduce rebate yields. PBMs are adjusting to this reality with:

- Revised Rebate Guarantees: PBMs may proportionally reduce rebate guarantees to reflect anticipated lower rebate yields.

- Modified Reconciliation Methodology: Rather than modifying rebate guarantees, many PBMs are adjusting rebate reconciliation methodology to account for the lower WAC of impacted products. The methodology modifications result in reduced rebate yields for plan sponsors.

The Rise of Biosimilars and Their Effect on Rebates

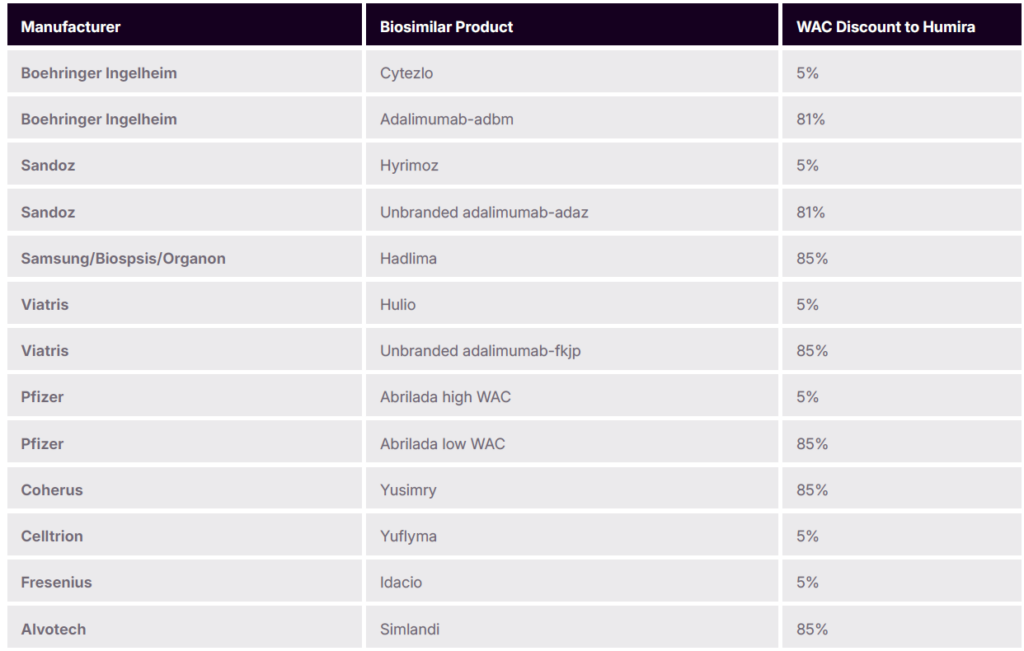

Biosimilars, particularly for popular drugs like Humira, are making significant inroads in the market, and have multiple pricing strategies. In January of 2023, Amjevita, was the first Humira biosimilar launched in the US market. Amgen, the manufacturer of Amjevita, entered the market with a dual pricing strategy which includes high WAC with high rebates or lower WAC with fewer rebates available.

Subsequently, numerous other biosimilars to Humira entered the US market with various pricing strategies at launch (low WAC, high WAC, and dual pricing strategies)

PBM Adjustments to Biosimilar Rebate Guarantees

With many low-WAC biosimilars entering the market, PBMs are adapting:

- Reduced Rebate Guarantees: PBMs might adjust guarantees downwards to match expected rebate yields from these low-WAC products.

- Expanded Rebate Reconciliation Modifications: Similar to the actions taken by PBMs to account for WAC reductions due to the AMP cap removal, they are adjusting rebate reconciliation methodology to account for the lower WAC of some biosimilars. The methodology modifications result in reduced rebate yields for plan sponsors.

Other PBM Rebate Guarantee Adjustments

Some PBMs are expanding their rebate reconciliation methodology modification to branded products they are removing from their formularies in favor of lower cost products such as generics.

Point-of-Sale (POS) Rebates: Increasing Popularity and Implications

POS Rebates in the Commercial Market

High-deductible health plans (HDHPs) and rising drug list prices are driving demand for POS rebates, which reduce patient out-of-pocket costs at the pharmacy counter. However, implementing POS rebates involves unique considerations:

- Service Fees: PBMs typically charge additional fees to administer POS rebates.

- Reduced Rebate Values at POS: To mitigate financial risk, PBMs often apply lower rebate amounts than what could be paid on the same claim under standard rebates.

Price Concessions in Medicare Part D

In Medicare Part D, while discussions around POS drug manufacturer rebates continue, no mandate yet requires drug manufacturer rebates to be applied at POS for Medicare beneficiaries. In addition to drug manufacturer rebates, the Medicare Part D benefit allows for some PBMs or Health Plans to receive price concessions from pharmacies in their networks. These price concessions are also considered rebates and plans must pass these price concessions (rebates) to beneficiaries at the point of sale.

The Inflation Reduction Act and Its Impact on Drug Prices and Rebates

Medicare Drug Inflation Rebate Program

The Inflation Reduction Act mandates that manufacturers who raise drug prices faster than the inflation rate must rebate the difference back to Medicare. This provision aims to curb inflation-driven price hikes for Part B and Part D drugs.

Federal Price Negotiation for Medicare

The Inflation Reduction Act also authorizes the federal government to negotiate directly with manufacturers for certain medications starting in 2026. The first wave of negotiations are complete and included 10 products; Eliquis, Jardiance, Xarelto Januvia, Farxiga, Entresto, Enbrel, Imbruvica, Stelara and some insulins. The current administration recently announced the results of this process.

For products included in the negotiations, it is mandated Part D plans include them on their formularies, despite the availability of lower-cost generics or biosimilars. This mandate may reduce expected overall beneficiary and plan savings for the program.

Key drugs subject to negotiation with lower cost generics or biosimilars entering the market include:

- Xarelto (expected generic competition in 2024)

- Januvia (expected generic competition mid 2026)

- Farxiga (generics available since January 2024)

- Entresto (expected generic competition in mid 2025)

- Stelara (biosimilars competition began in January 2025)

Emerging Scrutiny and Regulatory Actions on PBMs

Federal and State Investigations

PBMs face increasing scrutiny for their role in drug pricing. Recent events include:

- FTC Interim Report and Lawsuit: The Federal Trade Commission has highlighted practices in insulin pricing and other areas that may hinder transparency.

- Congressional Oversight: The House Oversight Committee has examined PBM practices, shedding light on rebate-related cost structures

Moving Forward

As the pharmacy rebate landscape continues to evolve, staying ahead requires proactive strategies and expert insights. By partnering with a trusted ally like Navion, you can navigate regulatory shifts and PBM changes with confidence, ensuring your pharmacy benefit plan meets both your financial goals and your employees’ needs. Let’s create solutions that deliver value, affordability and better outcomes for everyone.